Student Accounts

1098-T - Consent Guide

Do you want to get your 1098-T tax information as soon as it is ready? You can now get your information through MyCWU account instead of waiting for a paper form to be mailed to you! Just follow these easy steps to activate your online information!

1. Log into your MyCWU account

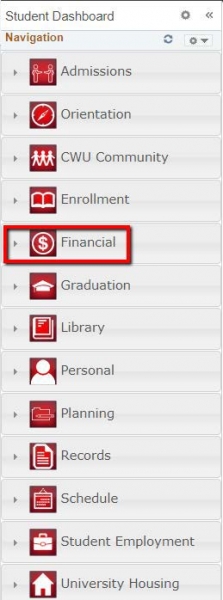

2. From the Student Dashboard Navigation, select Financial.

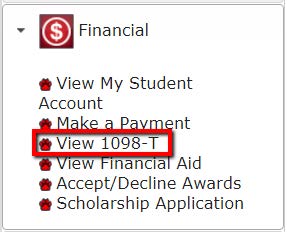

3. From the Financial toolbox drop-down menu, select View 1098-T.

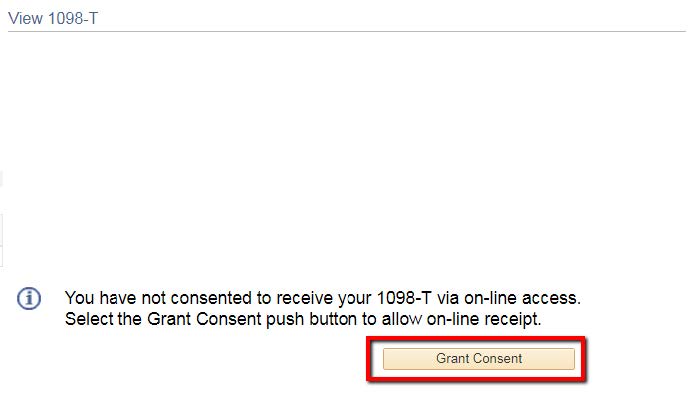

4. On the View 1098-T page, select Grant Consent.

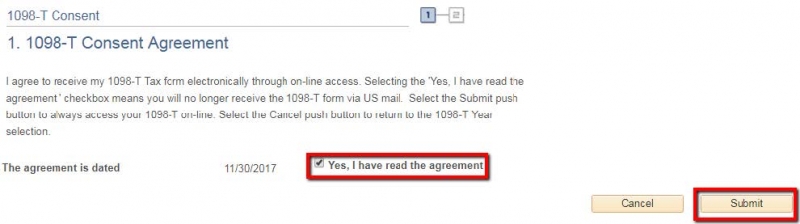

5. After reading the Consent Agreement, check the box indicating that you have read and understood the agreement.

6. Select Submit.

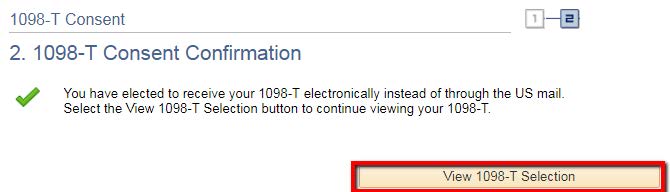

7. Next, you will receive confirmation that your electronic consent has been successful.

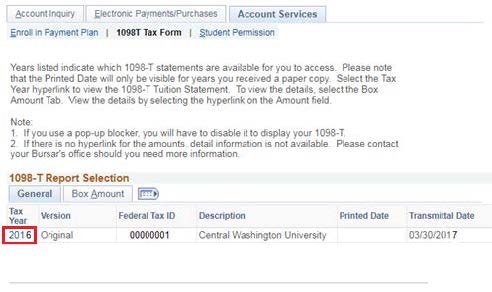

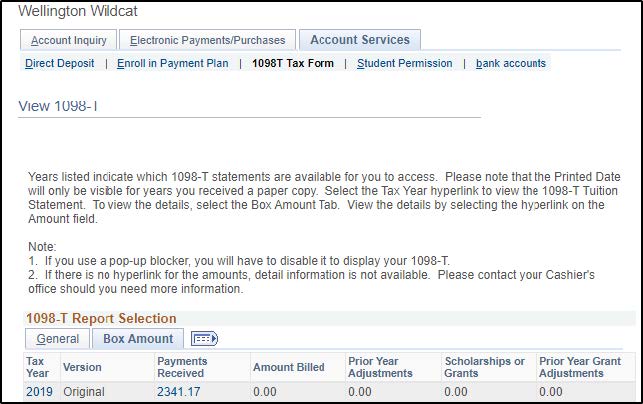

8. You may select View 1098-T Selection which will bring you to a page listing the 1098-T statements that areavailable for you to view.

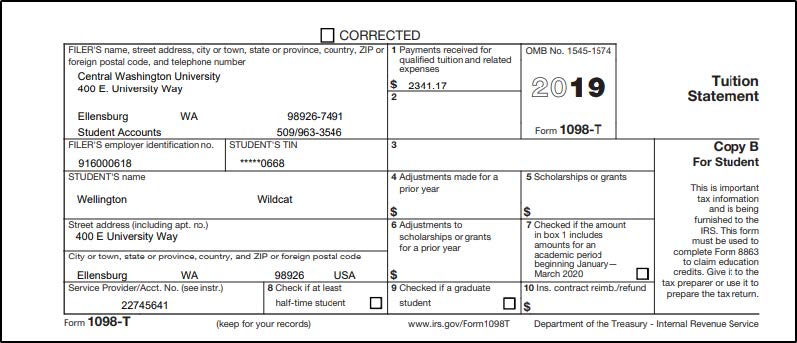

9. Select the Tax Year link to open a printable version of your 1098-T.

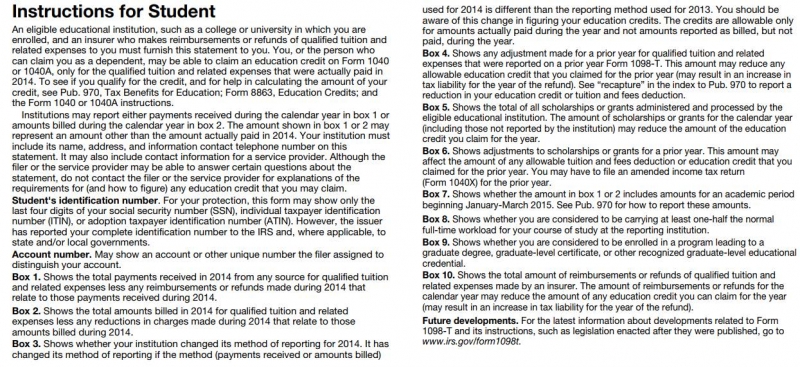

10. Instructions for the student are available by scrolling down on the PDF file

11. Return to the 1098-T Report Selection.

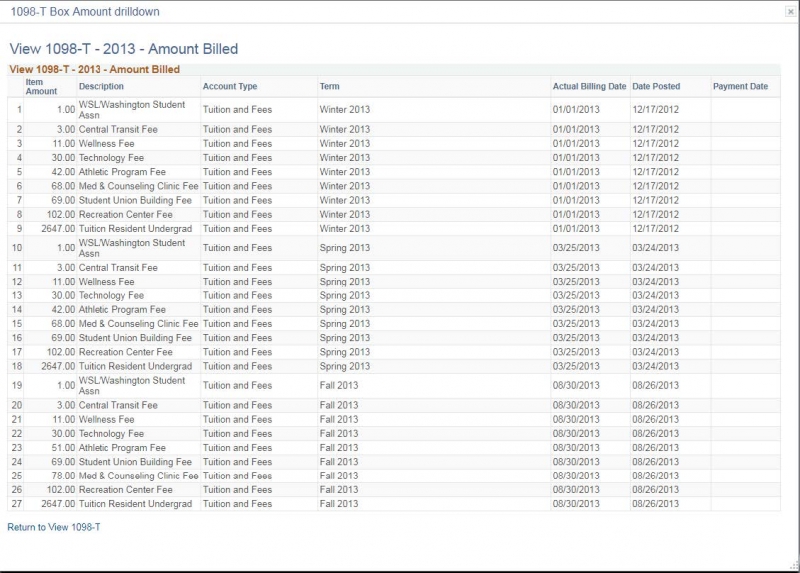

12. Select the Box Amount Tab and click the Amount Billed to open the itemized 1098-T Box Amount list.

13. If any or all of your tuition was paid by grants, scholarships, or a third party, this may result in a reduction ofyour qualified tuition amount. You may also not be required to generate your 1098-T tax form.

14. If you have any questions or concerns, or if your 1098-T information is not what you expected, please contactStudent Accounts at 509-963-3546.

CWU News

$4 million federal grant aimed at helping with school psychologist shortage

February 25, 2026 by Marketing and Communications

CWU Disability Services aims to provide equitable access to education

February 23, 2026 by Rune Torgersen

Questions? Contact Us.

Student Accounts

Barge 105

Barge 105

(509) 963-2224

Cashiers@cwu.edu