Financial Aid

Financial Aid Presentations

Fall 2023

Incoming First Year and Transfer students can find useful information in the links below:

Your 2023-24 Financial Aid Offer Letter Explained - watch short (six minute) video breakdown of the aid offer letter. Still have questions? Contact Financial Aid.

2023-24 Budget Worksheet - Create a spending plan! You have two options; simply select your preferred format:

- Active Excel Spreadsheet (calculates the totals for you)

- 2024 Budget Sheet (pdf) (print for hand calculations)

Complete your FAFSA: Video Tutorial

Federal Student Aid has created a video overview of the FAFSA process.

Completing the FAFSA Online - YouTube video.

Click the link above to view to visit CWU Financial Aid TV, a suite of short videos on a variety of financial aid topics. Browse by category or check out the curated video playlists.

The link in the title will take you to the Financial Aid "Forms & Worksheets" web page. You can access instructions for uploading financial aid documents to MyCWU as well as forms for verification, revision requests, and more!

ADDITIONAL FINANCIAL AID RESOURCES:

Free Application for Federal Student Aid

Students can use this site to file a Free Application for Federal Student Aid - (FAFSA). Be careful many search engines will give the wrong site. Do not use a .com or a .org site!. Go directly to www.fafsa.ed.gov. The FAFSA is the FREE Application for Federal Student Aid and you should NEVER have to pay a fee to apply.

1-800-4-FED-AID (1-800-433-3243)

Federal Student Aid ID Web site

Students and parents can use this site to request their FSA ID. You and your parents can use your FSA ID to sign and review your FAFSA, sign a Master Promissory Note and complete Entrance Counseling.

Student Aid on the Web

Student gateway to the US Government, delivering government information to services across your campus and around the world. Learn how to pay for college, why you should go, what you need to do to get there and how to talk to your family about college.

Federal Student Aid Estimator

See how federal student aid can help you pay for college!

LOAN RESOURCES:

Student Loan Education Site

The Washington State student loan education site contains a series of modules with information on specific topics. You can view modules related to the areas of interest listed above or view all modules available.

You can contact the student loan advocate at LoanAdvocate@WSAC.WA.Gov.

StudentAid.GovProvides online access to information on federal loans and grant programs. Access and manage your account, complete entrance counseling and exit interviews or change your demographic information. This site contains details on annual and aggregate loan limits. You may also download deferment and forbearance forms, change your payment plan, and review your payment history.

Complete the electronic Master Promissory Note (MPN). You and your parent(s) can complete and sign a MPN over the web. You will be required to use your FSA ID to login to complete an electronic MPN.

Student Loan Support Center: 1-800-557-7394

Loan Simulator

TAX RESOURCES:

Internal Revenue Service

Request a copy of your tax return at this site. Three different types of tax data are available: tax return transcripts, tax account transcripts and photocopies of tax returns. The Tax Return Transcript is usually sufficient for financial aid purposes and it’s free. IRS Forms and Publications can also be downloaded from this site. 1-800-829-1040

Publication 970 —Tax Benefits for Higher Education

This publication explains tax benefits that may be available to you if you are saving or paying education costs for yourself or, in many cases another student who is a member of your immediate family. Most benefits apply only to higher education. What is in this publication: Chapter 1 explains the tax treatment of various types of educational assistance, including scholarships, fellowships, and tuition reductions. Two tax credits for which you may be eligible are explained in chapters 2 and 3. These benefits, which reduce the amount of income tax you may have to pay, are:

• The American Opportunity Credit, and

• The Lifetime learning credit

Ten other types of benefits are explained in chapters 4 through 12. With these benefits, you may be able to:

• Deduct student loan interest;

• Receive tax-free treatment of a canceled student loan;

• Receive tax-free student loan repayment assistance;

• Deduct tuition and fees for education;

• Establish an contribute to a Coverdell education savings account (ESA)m which features tax-free earnings;

• Participate in a qualified tuition program (QTP), which features tax-free earnings;

• Take early distributions from any type of individual retirement arrangement (IRA) for education costs without paying the 10% additional tax on early distributions;

• Cash in savings bonds for education costs without having to pay tax on the interest;

• Receive tax-free educational benefits from your employer; and

• Take a business deduction for work-related education.

LOAN FORGIVENESS RESOURCES:

Public Service Loan Forgiveness (PSLF) Program

STATE OF WASHINGTON RESOURCES:

Washington Student Achievement CouncilProvides information on state programs such as the Educational Opportunity Grant (EOG), Washington Promise, Washington Scholar, and Guaranteed Education Tuition (GET).

1-360-753-7800

theWashBoard.org

College Success Foundation

OTHER RESOURCES:

Federal Student Aid Ombudsman

The student financial assistance Ombudsman site can informally help borrowers resolve loan disputes. Problems with Direct Loans, Perkins Loans, Guaranteed Student Loans and other programs are covered.

1-877-577-2575

CWU News

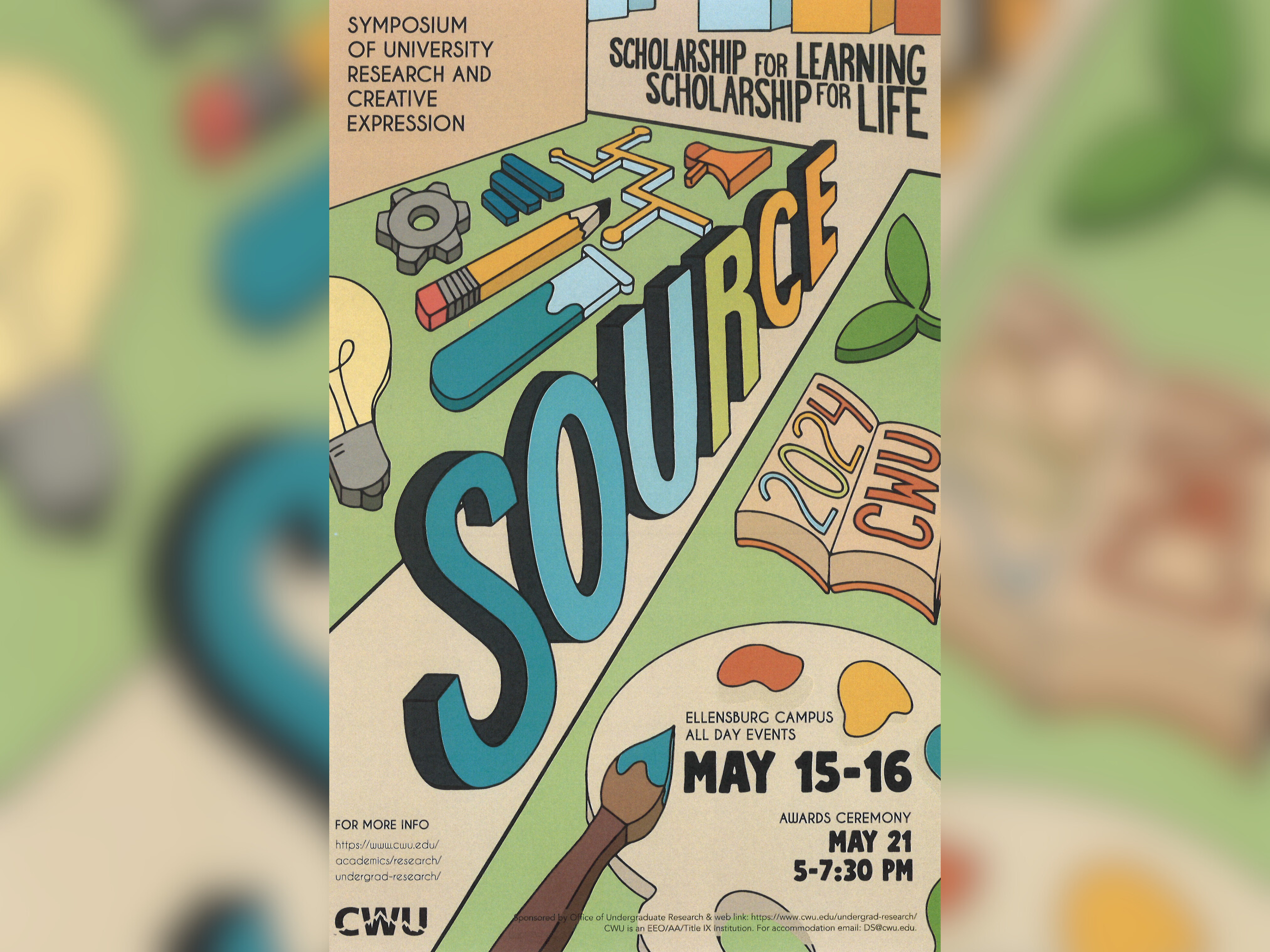

CWU to highlight student research at next week’s SOURCE conference

May 8, 2024

by Rune Torgersen

CWU Theatre and Film to present ‘Footloose’ the next two weekends

May 8, 2024

by University Relations