Financial Aid

Federal Higher Education Tax Benefits Guide

Great news for parents and students! The federal government provides a number of tax incentives that can help defray the cost of higher education. These incentives come in a couple of forms and are fully explained in IRS Publication 970 (pdf):

Tax credits, which directly reduce the amount of tax you owe; and

Tax deductions, which reduce the amount of income that you pay taxes on.

You may qualify to use more than one of the benefits, but there are some restrictions against this as well. It's a good idea to figure your taxes multiple ways so you can get the maximum benefit available to you. Please see full details at the IRS web site by clicking on the tax credit title link, which will take you to that page so you don't have to dig through the entire IRS publication. This information is provided solely for informational purposes and it is not intended to be tax or legal advice. For more information, see IRS Publication 970 - Tax Benefits for Education or consult a qualified tax advisor.

The American Opportunity Tax Credit

The American Opportunity Tax Credit was first made available in the 2009 tax year. It offsets the cost of tuition, fees, course-related books, supplies, and equipment for higher education by reducing the amount of income tax you are liable for. In addition, the credit is partially refundable—meaning that you may be able to claim the tax credit and receive a check from the IRS even if you owe no income tax!

The amount of the credit varies depending on income and how much you spent on higher education expenses, and how many eligible students are in your family. The American Opportunity Tax Credit was enacted by the economic stimulus bill, the American Recovery and Reinvestment Act (ARRA) of 2009.

The Lifetime Learning Tax Credit

The Lifetime Learning Credit (pdf) is available for all types of post secondary education, unlike the other credits. Use this credit once you have exhausted your eligibility for more advantageous credits. This credit may be particularly helpful to graduate students. There is no limit on the number of years you may claim this tax credit.

How to Claim Tax Credits

To claim any higher education tax credit, you must report the amount of your qualified expenses (less certain scholarships, grants, and untaxed income) on IRS Form 8863 - Education Credits and submit it with your Form 1040 or 1040A. See How to Claim Tax Credits (pdf).

Tuition and Fees Tax Deduction

The Tuition and Fees Tax Deduction (pdf) can reduce your taxable income by as much as $4,000. This deduction may be helpful to you if you are not eligible to take one of the tax credits. It is taken as an adjustment to income, which means you can claim this deduction even if you do not itemize deductions on Schedule A of Form 1040.

You are eligible to take the deduction if your modified adjusted gross income is $80,000 or less ($160,000 if filing a joint return). The amount of the Tuition and Fees Deduction you are eligible for depends on the amount of qualified tuition and related expenses paid for eligible students.

Qualifications

Expenses that you can deduct are tuition, fees, and amounts required to be paid to the institution for books, supplies and equipment (less the amount of certain scholarships and grants received) during the tax year for yourself, your spouse, or someone you claim as a dependent on your tax return. The expenses must have been for a student enrolled in one or more courses at an eligible* educational institution.

You can't claim both an education credit and the tuition and fees deduction for the same student for the same year, but you can take the deduction for one student and a credit for another.

You can't take this deduction if you deduct tuition and fees expenses under any other provision of the law (for example, as a business expense).

You can't claim this deduction if your filing status is married filing separately or if another person can claim you as a dependent on his or her tax return.

Figure your Tuition and Fees Deduction on IRS Form 8917 - Tuition and Fees Deduction.

Student Loan Interest Deduction

The Student Loan Interest Deduction (pdf) can reduce your taxable income by as much as $2,500. It is taken as an adjustment to income, which means you can claim this deduction even if you do not itemize deductions on Schedule A of Form 1040.

You can deduct interest paid on a student loan for yourself, your spouse, or your dependents. You are eligible to take the deduction if your modified adjusted gross income is $75,000 or less ($150,000 if filing a joint return). The amount of the Student Loan Interest Deduction you are eligible for depends on the amount of interest paid and your income.

Qualifications

Qualified student loans must have been used to fund educational expenses such as tuition, room and board, fees, and books for a student enrolled at least half-time and pursuing a degree, certificate, or similar program at an eligible* institution.

You cannot claim this deduction if your filing status is married filing separately or if another person can claim you as a dependent on his or her tax return.

Figure your Student Loan Interest Deduction using the Student Loan Interest Deduction Worksheet on page 34 of the IRS Publication 970.

The 1098-T Statement

You will receive information about your tax year educational expenses in a 1098-T statement from the institution of higher education you attended. Schools are required to send this information to each student and to the IRS by Jan. 31. (You might receive this by mail or electronically. Be sure to save this information, or give it to the person who claims you on their tax return if you don't claim yourself.)

Some schools report only tuition and fees on this form. If your 1098-T doesn't include amounts you paid for course-related books, supplies, and equipment, and these expenses are allowed for the credit you are taking, you can use your own records to figure the amounts paid for these items and report the total on your tax return.

See the 1098-T Statement Form (pdf)

Taxability of Student Financial Aid and Loan Forgiveness Programs

Scholarships, fellowships, and grants that you received and that are reported on the 1098-T may need to be reported as taxable income in certain circumstances, but are often tax-free. In general, if you are pursuing a degree, certificate, or program of training towards gainful employment, and used the funds to pay tuition, fees, or required books, supplies and equipment, these sources of assistance are not counted as taxable income.

If you've received a student loan that states it can be forgiven, canceled, or paid if you work for a certain period of time, in certain professions, for any of a broad class of employers, then the amounts forgiven may qualify for tax-free treatment.

*An eligible educational institution is any college, university, vocational school, or other post secondary educational institution eligible to participate in a student aid program administered by the U.S. Department of Education. According to the IRS, "it includes virtually all accredited, public, nonprofit, and proprietary post secondary institutions." The educational institution should be able to tell you if it is an eligible educational institution. Certain educational institutions located outside the United States also participate in the U.S. Department of Education’s Federal Student Aid (FSA) programs. NASFAA provides this information to students and parents solely for informational purposes and it is not intended to be tax or legal advice. For more information, see IRS Publication 970 - Tax Benefits for Education or consult a qualified tax advisor.

CWU News

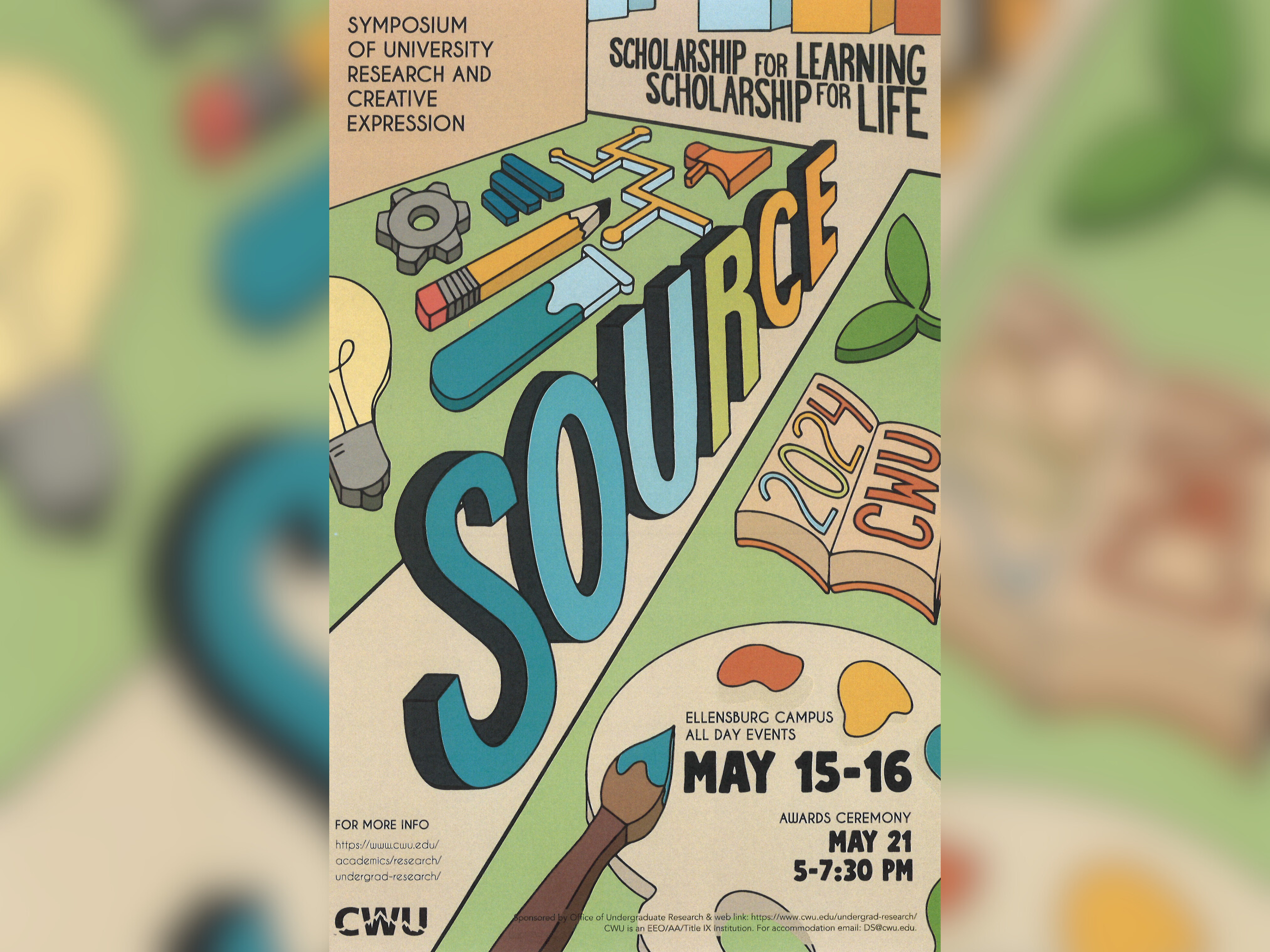

CWU to highlight student research at next week’s SOURCE conference

May 8, 2024

by Rune Torgersen

CWU Theatre and Film to present ‘Footloose’ the next two weekends

May 8, 2024

by University Relations