ISSS

Tax Information for International Students

If you earned money in the U.S. or a scholarship* from a U.S. school, this money may be considered as income and may be subject to federal income tax by the U.S. government. The Internal Revue Service (IRS) is the federal agency, which is responsible for federal income taxes.

* Please note, the CWU International Student Scholarship is not considered income.

The tax year is from January 1 - December 31st. Certain portions of the income you earn in the U.S. may be exempt from taxation due to tax treaties established between the U.S. and other countries. These tax treaties are unique to each agreement and aim to lower the taxable income determined by the U.S. government.

-

Why should you file a tax return?

- It is a legal requirement of the U.S. Failing to file may impact the status of your current visa and cause challenges for future U.S. visa applications

- Avoid penalties – If you miss the April 18th deadline you may face late filing penalties.

-

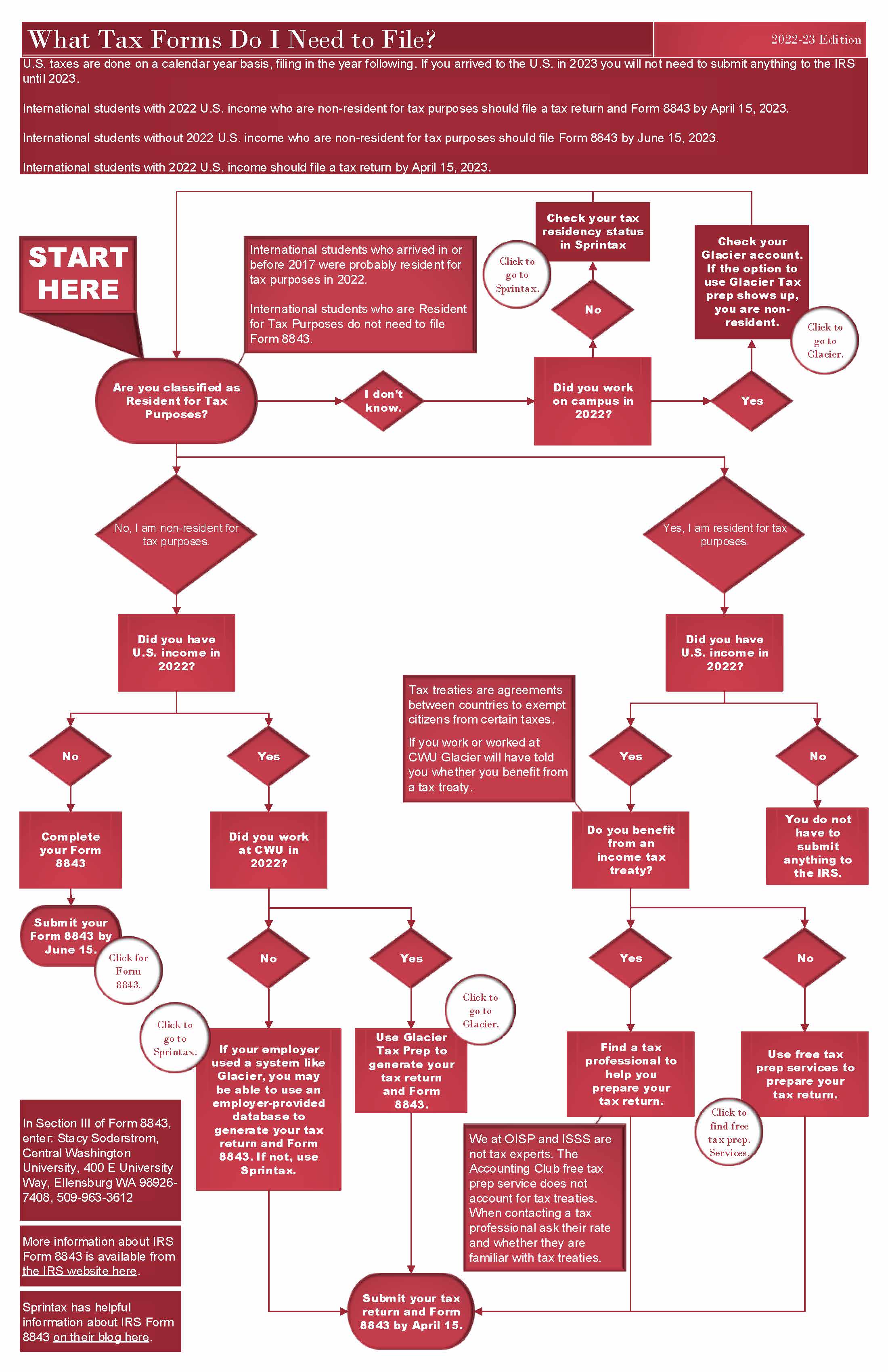

Filing your student tax return

As an international student or scholar in the U.S., you are obligated to file a U.S. tax return or Form 8843 each year of your stay, in almost all cases. Most international students should not use advertised tax prep services, as they do not account for your non-resident tax situation.

For students who work on-campus, we recommend you use Glacier Tax Prep, which is free through your Glacier account.

If you do not work on campus, you can prepare your tax return and/or Form 8843 through Sprintax.

- Sprintax is an independent tax service provider that charges fees. It does not have a relationship with CWU, but it is one of the few tax preparation services that account for non-resident tax circumstances.

If you do not have any income in the U.S., you are only required to file a Form 8843. To save on tax service provider charges, you have the option to complete the Form 8843 on your own.

Filing the Form 8843 is a requirement for most international students. This form serves as a declaration to the U.S. government that you are an international student and classified as a non-resident for income tax purposes. It is especially important if you have earned income from outside the U.S. during the tax year. Failing to file this form may result in potential taxation of your out-of-country income.

If Sprintax or Glacier Tax Prep determine that you were resident for tax purposes during the year for which you were filing, you can use resident tax preparation services. Most students in this situation can use a free file option. Students who are resident for tax purposes and benefit from a tax treaty exemption, should consult a tax professional to ensure that they get all the benefits they are entitled to.

-

Steps to use Sprintax, if needed

- Register here

- Complete each section

- Sprintax will prepare your tax return

- It will be available for download in your account

Sprintax maintains a blog and a YouTube channel that can help.

-

Other forms related to U.S. income taxes

W-4

- The form you complete when you start a job in the U.S.

W-2

- Your employer(s) will send you this form in January of the year after the income tax year (January 1 to December 31). It provides details about the money earned in each position held during that year, the federal income tax withheld, and any withheld Social Security tax. As a non-resident, you are not required to pay Social Security tax, so if any was withheld, you should discuss with your employer to seek a refund.

1099-INT

-

This form may be sent to you by your bank. It shows the amount of interest income you earned last year. While U.S. residents are taxed for this income, non-residents are not subject to taxes on interest.

1042-S

- In most cases, CWU will send you this form if you received a scholarship or graduate assistantship. If you received a tuition waiver, you will receive a letter from ISSS. The scholarship or waiver used for tuition or books is not taxable income. However, if your scholarship included money for room and board, that portion is taxable and needs to be reported.

1040NR

- You will need one of these forms to file a federal tax return. The latter is a simplified version of the 1040NR and will be what most use.

CWU News

Desire to help others drives future HR professional

May 15, 2024

by David Leder

CWU women’s rugby team earns six All-American selections

May 13, 2024

by University Relations

Questions? Contact Us.

Office of International Studies and Programs

Hebeler Hall 102