Financial Aid

Financial Need

Adjustments to federal, state, and institutional need-based aid are regulated by federal law. Please note that CWU will follow federal law when adjusting an award for any student who files a FAFSA and is offered need-based aid.

- The Pell Grant is a federal entitlement program and will be awarded to any eligible student. Pell eligibility is based on the Expected Family Contribution (EFC) as determined on the FAFSA. In addition, eligibility requires maintaining Satisfactory Academic Progress (SAP). Beginning 2013: The Pell Grant has a lifetime limit of 6 years or 18 quarters.

- Subsidized loan, grants, work study, and most gift aid are limited to covering financial Need. Beginning in 2014-15, subsidized loan has a lifetime limit of 6 years or 18 quarters.

- Students may receive merit aid that exceeds need and still receive non-need based loans such as unsubsidized student and parent loans, TEACH grant/loans, etc.

Please note: All aid is limited to Cost of Attendance (COA) and Central’s policy is to offer funding up to COA. Therefore, students may be offered unsubsidized loans, parent loans (PLUS), graduate PLUS or, upon request, an Alternative Loan to cover EFC and unmet need.

When adjusting the original offer of aid for additional resources or scholarships, Central will reduce institutional need based aid if institutional aid plus state aid exceeds the maximum, in that case the least desirable aid will be reduced first. If a PLUS loan has been offered to fill Need, it will be reduced, then unsubsidized loan (if it is filling Need). After that, the order of reduction will usually be Perkins Loan, subsidized loan, state gift aid, federal gift aid. If you have outside resources that exceed COA, we will contact your donors for permission to carry funds over to summer term or the next award year. Please see a financial aid counselor if you have questions on specific types of aid and how it would affect your financial aid award package.

Continuing Education

If you are taking Continuing Education and wish to receive financial aid:

- You must be a degree-seeking matriculated student.

- The courses must apply to a degree or certification that has been approved by the U.S. Department of Education (check with the Financial Aid Office).

- Courses used for continuing certification and educational endorsements numbered 500 are NOT eligible for financial aid.

- Tuition scholarships cannot pay for continuing education courses.

We are pleased to assist you in obtaining a financial aid award to attend Central Washington University! The aid offer is contingent on your eligibility at the time of disbursement.

Estimated Educational Expenses

Please visit the 2023-2024 Cost of Attendance page for estimations.

Expected Family Contribution (EFC)

The Free Application for Federal Student Aid (FAFSA) data is used to calculate an "Expected Family Contribution" (EFC). This assessment of assets, prior year income, and personal information determines the amount the family is expected to contribute from its resources to meet the student’s cost of attendance. If you have experienced a significant reduction of income compared to the previous year, please document the change and contact our office.

The data gathered from the FAFSA is used by the government to determine the amount of money you or your family could reasonably contribute toward your education for this year. The expected family contribution appears on the student aid report (SAR) which you received after submitting the FAFSA. The EFC may or may not be the amount you actually end up paying for college.

Need

The financial “need” is the difference between CWU’s estimated "Cost of Attendance" (COA) and the Federal determination of the EFC.

COA – EFC = Need

Your award may include government sponsored grants, work study employment, and subsidized loan if you have “need.” Central attempts, with limited funds, to offer aid up to the COA. Unsubsidized student loan and parent loan may be offered to cover EFC and unmet COA.

Disbursement

- Accept, reduce, or decline your aid at MyCWU Sign In > Financial Toolbox > Accept/Decline Awards.

- Census date is the day after the add/ drop change of schedule period. Make sure to be fully enrolled on census date. Grants are prorated to census date enrollment and cannot be adjusted for late registration.

- Complete new borrower's loan entrance counseling on the Federal Student Aid site.

- Sign on-line master promissory notes for student and parent on the Federal Student Aid site.

- Parents must complete the PLUS loan request process at the Federal Student Aid site for a parent loan.

- If you are pre-enrolled as a full-time student, your aid will credit to your student account on the third day of class. Adjustments and disbursements for less than full time enrollment will be made after census date.

- Refund of excess funds usually occurs 3-4 days following census date. See Student Financial Services for refund dates.

See the Financial Aid page for additional information.

Aid Programs

CWU Participates in federal, state, and institutional aid programs.

Tuition awards are given for merit, recruitment, need, dependents/spouses of deceased or disabled veterans, firefighters and police, and certain dependents of CWU employees.

Transfer and First-Year Students

Send an official final academic transcript to Admissions. We cannot disburse aid until Admissions has your final transcript.

Mid-year transfers; please contact your prior school immediately to inform them you are transferring and ask them to cancel any pending aid.

Part-Time Employment

Student jobs are listed on the Student Job Board, located on Human Resources - Student Employment Website. Bring appropriate original ID to the Student Employment Office to complete the I-9 form before you begin to work.

Work Study Program

Work-Study is a need-based financial aid employment award and is available to undergraduates, post-baccalaureates and graduates during the academic year. Hourly wages begin at minimum wage and go up to $15+ per hour, depending on job duties. If you have financial aid need that is not filled with grants and scholarships, or have a subsidized loan, you are probably eligible. Eligible students will receive the Work Study Personnel Action Form in the mail soon after the initial financial aid award if you checked on the FAFSA that you are interested in Work Study. If you did not indicate interest on the FAFSA but would like Work Study, see a Financial Aid Counselor. Go to the Student Employment Website for more information and to search the online Job Board.

Financial Aid Adjustments

You are required to report all resources such as scholarships, guaranteed sources, and DVR. We will make necessary adjustments. It is always our policy and intention to make adjustments to the best advantage of the student if possible. Financial Aid is credited to your account by the third day of class if you are pre-enrolled in 12 credits (10 if Masters). Adjustments are made for less than full-time enrollment on Census date (immediately following add/drop). Please see Student Accounts for Refund day. Students who receive financial aid funds and consider withdrawing during the quarter should meet with a Financial Aid Counselor prior to withdrawal to discuss resulting financial obligations. Complete withdrawal always results in Financial aid suspension, but may be appealed for special circumstances. Please review the Return of Funds Policy carefully before making a decision.

A grade of No-Show (NS) can result in some or all aid being canceled, creating an immediate amount due.

Education Tax Incentives

Your Responsibility

- Use your legal name, Social Security Number, and birth date for both the FAFSA and CWU admission application.

- Complete registration by the end of add/drop change of schedule period.

- Inform the Financial Aid Office, in writing, if you receive additional resources from other sources such as scholarships, DVR, or employer reimbursement of tuition.

- Accept, reduce, or decline your aid go to MyCWU > Sign In > Financial Toolbox > Accept/Decline Awards

- First time student borrowers: Complete new borrower's entrance counseling. All first time borrowers: Complete the student and/or parent Electronic Master Promissory Note and online PLUS Request.

- If an unwanted Federal loan pays to your account, write VOID on the refund check and return to the Financial Aid Office within 14 days with written notice to cancel or reduce the loan. Please contact the Financial Aid Office if you want to return loan funds but do not have a paper check to return, and you may want to reduce or cancel future loan disbursements

- Master’s candidates must enroll in at least 5 credits of course work at #501 level or higher to receive aid

- Read and respond immediately to any correspondence from the Financial Aid Office, which will normally be sent to your CWU email address.

- Keep your address and phone number updated on >MyCWU

- Check CWU Outlook email and MyCWU > Sign In > Financial Toolbox frequently. You can set up your Outlook CWU email to forward to your preferred email address.

- Check your “To Do List” on MyCWU frequently.

- Make progress toward a degree as described in the "Satisfactory Academic Progress (SAP) Standards Policy.” The policy is available online.

- Reapply for financial aid annually.

- Keep your award notices, promissory note, disclosure notices, and FSA ID info in a safe place

- Inform the Financial Aid Office if you transfer to another school

- Make sure you know the details of your loan repayment options as you prepare to leave school

- Begin repayment of your loans within six months of leaving school and maintain good communication with your lender(s)

CWU News

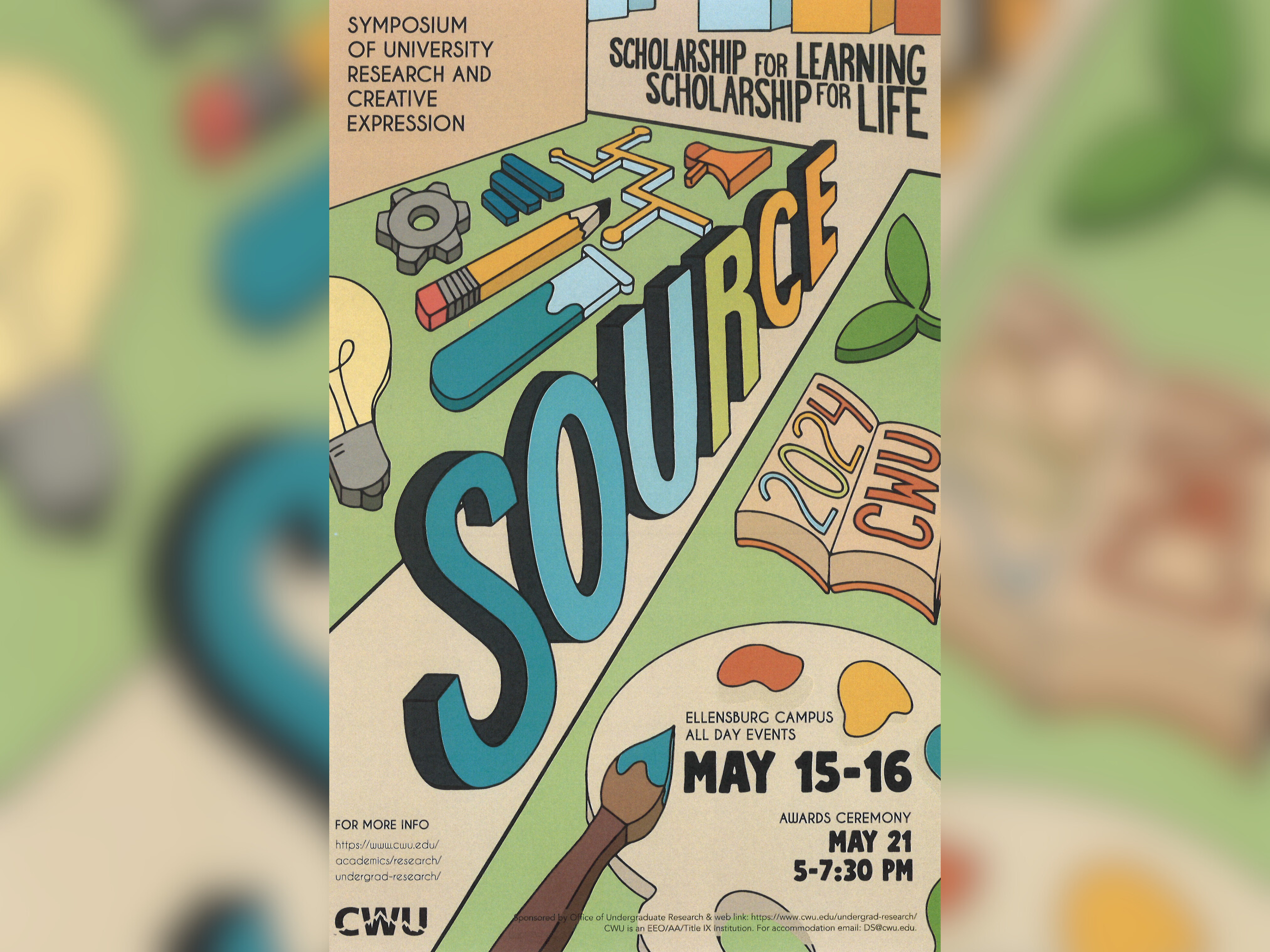

CWU to highlight student research at next week’s SOURCE conference

May 8, 2024

by Rune Torgersen

CWU Theatre and Film to present ‘Footloose’ the next two weekends

May 8, 2024

by University Relations

Questions? Contact Us.

Financial Aid

Bouillon Hall 106