Human Resources

Student Employee – Handbook

Welcome to CWU! We are glad you are here, we will be happy to help you, and we hope you enjoy your student work experience!

Answers to common inquiries for students hired to work at Central.

Welcome to the CWU Workforce

As both a student and employee, you are a valuable member of our campus community. We rely heavily on student employees to help provide fast and efficient service to the student body. We hope you enjoy your experience working at CWU and that you have an opportunity to develop work habits, skills, and contacts that will serve you well in your working life.

This handbook is designed to help you understand the terms of your employment and your responsibilities as a temporary employee of CWU. Please read it thoroughly, and refer to it often.

Employment Discrimination and Grievances

It is the policy of Central Washington University to recruit, hire, & promote persons in all job titles, including student jobs, without regard to race, color, creed, religion, national origin, sex, sexual orientation, gender identity and gender expression, age, marital status, disability, genetic information, or status as a protected veteran.

The Office of Student Employment is part of the Human Resources department. Students who require assistance should call (509) 963-1202; we will be happy to help.

If you have an issue or a grievance, start by discussing the problem frankly with your supervisor. Your supervisor is usually the person who can make changes and adjustments in your working conditions but cannot help you unless s/he knows there is a problem. Most difficulties can be solved through discussion with your supervisor. If you have not discussed it plainly, don't assume your supervisor already knows about the problem. Make sure you explicitly inform them, as early as possible once you have identified a problem, and give your supervisor a reasonable chance to help correct the situation. If you have already discussed the problem with your supervisor or do not feel comfortable talking with your supervisor, then you should contact your supervisor's supervisor, and on up the chain of authority in your department. See Discussing Problems section.

Students who believe they have experienced employment discrimination in regard to race, color, religion, creed, age, national origin, disabled or Vietnam Era Veteran status, marital status, sexual orientation, disability, or gender, should contact Human Resources for guidance. Sexual harassment is considered a form of sex discrimination and is prohibited. The Equal Opportunity office is located in Mitchell Hall 1st Floor and may be contacted at (509) 963-1202 or hr@cwu.edu.

If your concern involves disability accommodation, please contact Disability Services for guidance. They will help you request a reasonable accommodation and guide you through the process of working with your department to develop a reasonable accommodation plan. Disability Services is located in Hogue Hall #126 and may be contacted at (509) 963-2214, or ds@cwu.edu.

If your issue involves pay problems or back pay, please see Student Employment in Mitchell Hall 1st Floor, seo@cwu.edu or (509) 963-1202. (NOTE: Work Study students should contact the Financial Aid Office, Bouillon Hall, Room 106, financialaid@cwu.edu or (509) 963-1611.) We will work with your department and Payroll to gather the necessary information from your employing department and help you obtain the pay that you have earned.

If your grievance issue is not related to discrimination or disability issues, or if you have already discussed the problem with your supervising department or do not feel that you can talk with your department, please contact Student Employment at (509) 963-1202.

CWU is a Drug-Free Workplace

CWU prohibits the unlawful manufacture, distribution, dispensing, possession, or use of a controlled substance in the workplace. You may not work your shift while under the influence of illegal drugs or alcohol. Appropriate disciplinary action, which may include termination, will be taken against any employee for violation of this policy. If you have questions or concerns about drug or alcohol use or abuse, please contact the Wildcat Wellness Center, at (509) 963-3213.

Duration of Employment

Student employees are hired on a temporary, hourly, at-will basis, and employment can be terminated by either employee or employer at any time. Termination can be for any reason except one that is considered to be based on illegal discrimination (see above section on Discrimination and Grievances). You are not required to give advance notice if you decide to leave your position. Your employer is not required to provide advance notice before dismissing you. It is considered good practice to provide 2 weeks notice.

Normally, your job will last the duration noted on the Upload Spreadsheet. However, the Upload Spreadsheet is not a contract, and you are not guaranteed employment through any specific date. A job may end early for many reasons, including for example: budget constraints, lack of work, inability to perform job duties, inability to interact reasonably with co-workers, safety violations, insubordination, repeated lateness or absences, and/or scheduling conflicts.

Your Responsibilities as an On-Campus Student Employee

Before you begin work, you and your employer must submit hiring documents to the Student Employment Office. Visit the I-9 information page for a list of those documents.

You may begin work as soon as you and your employer have completed all hiring documents (background check and I-9), your credit enrollment status has been verified, and you have authorized a background check by signing the authorization form or logging into HireRight and completing the on-line authorization process. (NOTE: If there is an issue with the background check, staff in the Student Employment office may need to contact your employer to discuss the issue.)

Important Exception: If you are work study, the goal amounts must be approved by the Financial Aid before you begin working.

If you work more than one on-campus job, you must inform each employer. Your work hours must be coordinated to stay within the prescribed limits (refer to Work Schedule section).

You are expected to show up on time for all scheduled shifts. On-time means you are at your work station ready to work at the beginning of your shift. You may need to arrive at your job site a few minutes early to take off your coat, comb your hair, or make a rest stop. You are expected to work until the end of your shift. Sometimes during scheduling, students underestimate the time it takes to travel across campus, or a particular professor often keeps the class late, causing chronic late arrival times. Talk to your supervisor if you need to adjust your work start time, rather than just being late frequently. Most supervisors will be able to make arrangements to help you be there when you are expected. Don't agree to a schedule that you aren't certain you can maintain.

If you are unable to work due to illness, you are expected to call your employer before your shift each day you will not be at work. Give as much advance notice as possible. Your employer may need time to find a replacement.

Requests for time off should be limited to emergencies (such as a family medical crisis or funeral). When an emergency does arise, provide as much advance notice as possible. If you have special days you want off to attend a concert, go on a trip, etc., discuss it as far in advance as possible to allow your employer to cover your shift. Some employers may want you to coordinate with other employees to arrange coverage for your shift. Ask your employer to explain their departmental policy for requests for time off at the time of hire if it is not covered in your orientation.

Normally, you should not request time off to finish class assignments or study for an exam. When you accept an on-campus job, your employer is counting on you to be available when you agreed to work. You must carefully plan your schedule so class work is not left to the last minute. Discuss your employer's policy for schedule adjustments before you request time off.

Conduct on the Job

Students are expected to dress appropriately and conduct themselves in a professional manner while on the job - this includes showing courtesy and respect to supervisors, co-workers, and the public. Failure to do so can lead to immediate dismissal. Dress code will differ between departments, depending upon job duties and visibility to the public. Dress code includes good grooming habits, regular hygiene, and limitation on wearing fragrances (many people are allergic to perfume and cologne). Discuss proper dress code with your supervisor.

You should not expect to study or work on classroom assignments while on the job.

You may not use State equipment or supplies for personal use or classroom assignments. This includes using the phone, printer, photocopy machine, FAX, computers, and accessing the Internet for non work-related purposes (Facebook). You also cannot install personal software on university computers without the permission of your employing department.

You should not have family/friends visit you at work unless allowed by your supervisor on an occasional basis. If a family member or friend does visit, keep visits brief and rare.

The federal Family Educational Rights Privacy Act (FERPA) requires that student information be protected and kept confidential. If you gain access, through your job, to information about other students, you MUST keep it confidential. Sharing confidential information with others who are not authorized to receive it (outside the scope of your job duties) is a serious federal violation and is cause for immediate dismissal, and could lead to further disciplinary action.

Food is not normally allowed at your work station. Eating while on the job interferes with your ability to complete a task, may clog computer key boards and other office equipment, stain paperwork, and presents an unprofessional image to the public. Non-alcoholic beverages are normally allowed within reasonable limits. This does not include oversized or overfilled cups that cannot be consumed discreetly, or containers with wet condensation which may damage paperwork. Discuss the office policy on food and beverages with your supervisor. If allowed, remember to use reasonable standards regarding frequency, and to eat or drink it discreetly, putting it away when interacting with the public. Food and beverage must be prepared or purchased before your shift begins (also see section on Breaks). You may not use alcoholic beverages at work, and must not arrive for your shift after consuming alcohol or impaired by alcohol consumption from the day before. Please see the University Policy on alcohol and controlled substances in the workplace

Discussing Problems

If a problem develops between you and your employer, you should attempt to resolve it immediately within normal departmental channels. Problems should be raised with the person(s) affected, and discussed calmly and in a courteous manner at the point it is first identified. Delays and/or confrontations will usually make things worse. If you need assistance from your employer, please talk to them before the problem gets bigger. Most difficulties can be resolved by talking with your supervisor. We suggest that for best results, you try to be frank about the problem, (don't assume they already know) and maintain a respectful and cooperative demeanor, suggest alternative solutions if possible, and select a location away from the work space for the discussion. Your supervisor cannot help you to improve the situation if they do not know about it, and they cannot be expected to "just know." Although it may be difficult to discuss problems, you will encounter them in your working career, so why not start now and learn to communicate with your supervisor?

If you still have a problem, even after you have tried speaking with your supervisor, feel free to contact your supervisor's supervisor, and go up the chain of authority in your department. If you have already tried this avenue and still seek resolution, please contact Student Employment for assistance, at (509) 963-1202. If the issue appears to involve discrimination based on protected group status and/or concerns regarding Title IX, please Contact Human Resources at (509) 963-1202. For issues involving violations of university ethics policy, please contact the university's ethics advisor Staci Sleigh-Layman at (509) 963-1256.

You may sometimes clash with a supervisor's management style or disagree with a task you are assigned to do. When that happens, the supervisor's request will prevail, unless physical or verbal abuse is present, or you are asked to perform an illegal activity. Try to cooperate and be willing to comply with the direction of your supervisor, and remember that they, not you, are ultimately responsible for the work that is performed in the department, so they must be allowed to control how the task is done.

Enrollment Requirements

Student employees must enroll for a minimum of 6 credits per term (5 credits if enrolled in a graduate master's degree program and enrolled for graduate level classes). If you drop below 6 credits during any term (except in summer, when you can continue to work as a student employee if you are pre-registered for at least half-time fall credits), you must stop working as a student employee. Your employer may continue to hire you as a temporary employee through the Office of Human Resources. See Working Summer Term for additional information.

Work Schedule

Your work hours will be determined by you and your supervisor. Normally, work hours can be arranged around your class schedule. Some jobs may require specific hours which cannot change to fit your class schedule during a future term. Discuss the flexibility of work hours with your supervisor before you accept the position to avoid future problems. If you know that you will have sports or other commitments in a certain quarter, bring this up during the interview so that you and the supervisor are clear on expectations. International student employees CAN NEVER exceed 19 hours per week during the quarter while classes are in session; there are very severe penalties for students and employers who exceed their limits. Non-international students can average their hours over the month.

Pay Rates

On-campus departments set their own pay rates. All students must be paid at least the current minimum wage per hour. Minimum wage is established each January 1 in Washington State. Information regarding the current minimum wage and how it is calculated may be found at the Labor and Industries News page. Discuss the wage scale with your individual employer.

Breaks / Meal Period

If you are scheduled to work a shift that lasts 4 consecutive hours, you must be provided a paid break of 10-15 minutes which should fall approximately halfway into your 4 hour shift. You must be provided one paid break for every 4 consecutive hours you work.

If you are scheduled to work a shift that lasts 5 or more consecutive hours, you must be provided an unpaid meal break of at least 30 minutes that should, again, fall approximately halfway into your shift.

Breaks and meal periods may not be accumulated and taken at the end of a shift, such as not taking a break and leaving early. The intent of a break is to provide a rest period during a shift in order to promote safety and productivit

Overtime

Overtime refers to working more than 40 hours in a one-week period (Sunday - Saturday).

Normally, student employees are not allowed to work overtime but overtime may occur during vacation or break periods. If you do work more than 40 hours in a one-week period, you must be paid the normal overtime rate of one-and-a-half times your regular hourly rate for the extra hours you worked above 40. If you are working in two or more departments, the department that works you the 41st hour for that week and beyond, is the department responsible for paying the overtime. Make sure you inform your supervisors if you have more than one job. Overtime is paid manually in our system, so if your department does not know you worked somewhere else, and how many hours you worked, they will not be aware that they should pay you the overtime rate. Check your pay stub carefully to make sure you received the overtime pay and that it is correct. Report errors promptly to the student employment office and your supervisor.

Volunteering

You may not volunteer additional hours to any department or employer that has hired you for pay. You may not volunteer to do any task similar to duties you perform anywhere on-campus for pay. Employers may not suggest or require that you volunteer, and may not offer any reward or penalty for your volunteering or not volunteering. Report violations to Student Employment.

Web Clock

Pay Dates / Pay Periods

You will be paid on the 10th and 25th of each month. There is a 10-day delay between the end of a Pay Period and pay day. Your employer must pay you for all hours you work and cannot withhold payment for hours worked for any reason. If your department refuses to pay you for hours you worked, contact Student Employment for immediate assistance. Federal Work Study wages may NOT be garnished for any reason except to pay account charges to the school for bona fide educational expenses. Other types of wages may be garnished if so ordered.

IMPORTANT: Your first pay check may be delayed by one pay date if the submission deadline for that pay period is missed. To avoid this, hiring documents must be received by Student Employment by the first day of the pay period in which you begin work. For example, if you begin working on the 12th day of March, your hiring documents must be received by Student Employment by the 1st day of March. If received later than the 1st, the time you work between the 12th and the 15th (end of pay period) will be added to your first paycheck, which you will receive on the 10th of April, the following month. If your hiring documents arrive on March 1st or sooner, your first pay date (for hours worked 12th - 15th) would be March 25th.

Pay Periods are the 1st - 15th (forms are due by the 1st); and 16th - the end of the month (forms are due by the 16th). If you are hired after the first day of a pay period or your employer delays submitting your hiring documents, your first pay check will be delayed and will contain all hours worked through the end of that current payroll period. Student Employment cannot activate you on the payroll unless we receive a hiring form.

Pay checks for all student employees will be either paid through direct deposit, or mailed to your home address via US Mail; you must choose a method of payment when you begin employment. You are encouraged to have funds deposited directly into your checking or savings account; you do not have to bank locally to enjoy this service.

To sign up for direct deposit, you can sign in to MyCWU > Main Menu > Human Resources > Self-Service > Payroll and Compensation > Direct Deposit.

If you have a special payroll check for some reason, you can pick it up at the Cashier's Office, Barge 104, with picture ID.

Number of Hours You Can Work (Academic Year)

The number of hours you can work depends upon your enrollment status and may change if you drop credits. Limits refer to the maximum number of hours you can work on-campus, and are per student (not per job). Limits also include any off-campus Work-Study job. (NOTE: Non-Work Study off-campus jobs are not subject to these limits. You may work off campus privately (not on Work Study) as many hours as you wish; however, we encourage you to ensure you can complete your coursework obligations before committing to an off-campus job that requires a lot of work hours.

Student employees must enroll for a minimum of 6 credits per term (5 credits if enrolled in a graduate master's degree program and enrolled for graduate level classes). If you drop below 6 credits during any term (except in summer, when you can continue to work as a student employee if you are pre-registered for at least half-time fall credits), you must stop working as a student employee.

Enrolled 12 or more credits

While you are enrolled for 12 or more credits (10 credits for graduate students enrolled in a graduate masters program), you can work up to 19 hours per week (and must sign a Public Employees Retirement System (PERS) waiver form).

Enrolled less than 12 credits

If you drop below 12 credits (10 for grads in a masters program), you are limited to 69 hours per month (about 15 hours per week). This limit involves the University's retirement system and cannot be waived.

Dropping below 12 credits during the academic year also affects summer employment. Please refer to the Student Eligibility/Max Hours page for further guidance.

Reporting On-The-Job Injuries

If you are injured on the job, you should report the injury to your supervisor immediately. Your supervisor will provide you a Campus Accident Report Form. Complete the form and return it to your supervisor, who will forward it to Environmental Health and Safety (EHS).

As an employee of CWU you are covered by Worker's Compensation Industrial Insurance. This insurance will cover all medical expenses associated with work-related injuries and may cover lost wages if you can't work because of your injuries.

Contact EHS at (509) 963-2252 if you have questions about Worker's Compensation or safety concerns.

Working During Breaks

If you maintain full time credits during all terms of the academic year, you can work 40 hours per week during Winter and Spring Break. If you drop below full time credits during any term in which you worked as a student employee, you are limited to 69 hours per month during the term AND the break that follows that term, including summer. To work as a student employee during a break, you must have attended CWU during the term immediately before the break, and be pre-registered for at least half time credits in the term immediately following the break.

If you are not enrolling for the next quarter, your employment ends after you take your last final.

Refer to the Student Eligibility/Max Hours page to help determine how many hours you are eligible to work per week while enrolled and over breaks.

Working Summer

Continuing students do not have to be enrolled Summer Term to work and may be able to work up to 40 hours per week if they maintain full-time credits all terms of the previous academic year, and are pre-registered for the upcoming Fall Term.

If you drop below 12 credits (but are still at half-time or above) during any term of the previous academic year in which you worked as a student employee, you will be limited to working a maximum of 69 hours per month during the entire summer.

If you enroll for half-time or more total credits during the summer, your hours per week will be limited while classes you are enrolled in are in session. To determine the total number of credits you are enrolled in summer, add together all credits for all summer sessions. Before you finalize your summer work plans, contact your employer and check the maximum eligible hours page to verify the number of hours you can work.

Taxes

All earnings (including Work-Study) are subject to federal income tax withholding and must be reported on your tax return. You will receive a W-2 form from the Payroll office each year in late January or early February. The W-2 form documents earnings you received payment for during the calendar year to include on your federal tax return. Contact the Payroll office if you worked on campus but did not receive your W-2 form, or if the information is not correct. Social Security taxes are not deducted while you are enrolled for half-time or more credits. Federal law requires that Social Security tax be withheld from your pay if you work during summer quarter and are not enrolled in at least half-time summer credits. (There is a special exemption from paying Social Security [FICA] tax for students who are enrolled at least half-time and working at the institution where they are enrolled. It does not apply during break periods of over 5 weeks in duration. [reference IRC section 3121(b)(10)].)

You may change your tax withholding information anytime by going to self service. Your W-4 is defaulted to single zero. Remember to update your W-4 form in self service if your information changes, such as name, marital status, or number of exemptions claimed. If your address changes, you must change it with the Registrar AND with the Payroll office. The address change form can be found on the Payroll website. The address you provide is where your W-2 wage statement will be sent in January for tax purposes. If you have paychecks mailed to you, they will go to the payroll address under self service, not the address on the Student Information system. Payroll must pay you under the name listed on your Social Security card. Employers are fined if they pay someone under a different name.

How Working Affects Financial Aid

If you work as a Regular Student Employee (not Work-Study), your current year financial aid award will not be affected. Your earnings will be reported on your next year's Financial Aid Form (FAFSA).

A Work-Study award may reduce loans in the current year, because Work-Study is a need-based financial aid award and must fit within your determined "need." However, Work-Study earnings are excluded from income for purposes of determining future financial aid eligibility. When you file your next year's Financial Aid Form (FAFSA), report Work-Study earnings on Worksheet #C. That amount will be deducted from the income reported on your tax return and will not affect your eligibility for need based aid in the future year. Washington State residents are given priority for State Work Study awards. It is possible for a non-Washington resident to have a State Work Study award, but only after residents have been awarded or under special circumstances. Most non-Washington residents will be awarded Federal Work Study.

Important Information Regarding Off-Campus Private Employment Listings on the Job Board

Contact employers directly to apply. Contact information is included on each listing. Employers are instructed to notify us when a position is filled. If a job is posted, we assume it is still available. If you find a listing that is filled, please let us know so we can remove it. Please contact Financial Aid if you experience a problem with an employer included on the Job Board.

Student Employment does not post jobs which appear to discriminate against applicants on the basis of race, color, religion, creed, age, national origin, disabled or Vietnam Era Veteran status, marital status, sexual orientation, disability, or gender.

The Financial Aid office acts only as a referral service and makes no particular recommendations regarding employers. We make no representations or guarantees about positions posted by this office. We are not responsible for safety, wages, working conditions, or any other aspect of off-campus employment. Due to the volume of jobs received by this office, we are unable to research the integrity of each organization or individual person who lists a job with us. Therefore, you are urged to exercise caution when applying for or accepting private off-campus employment, as you are doing so at your own risk

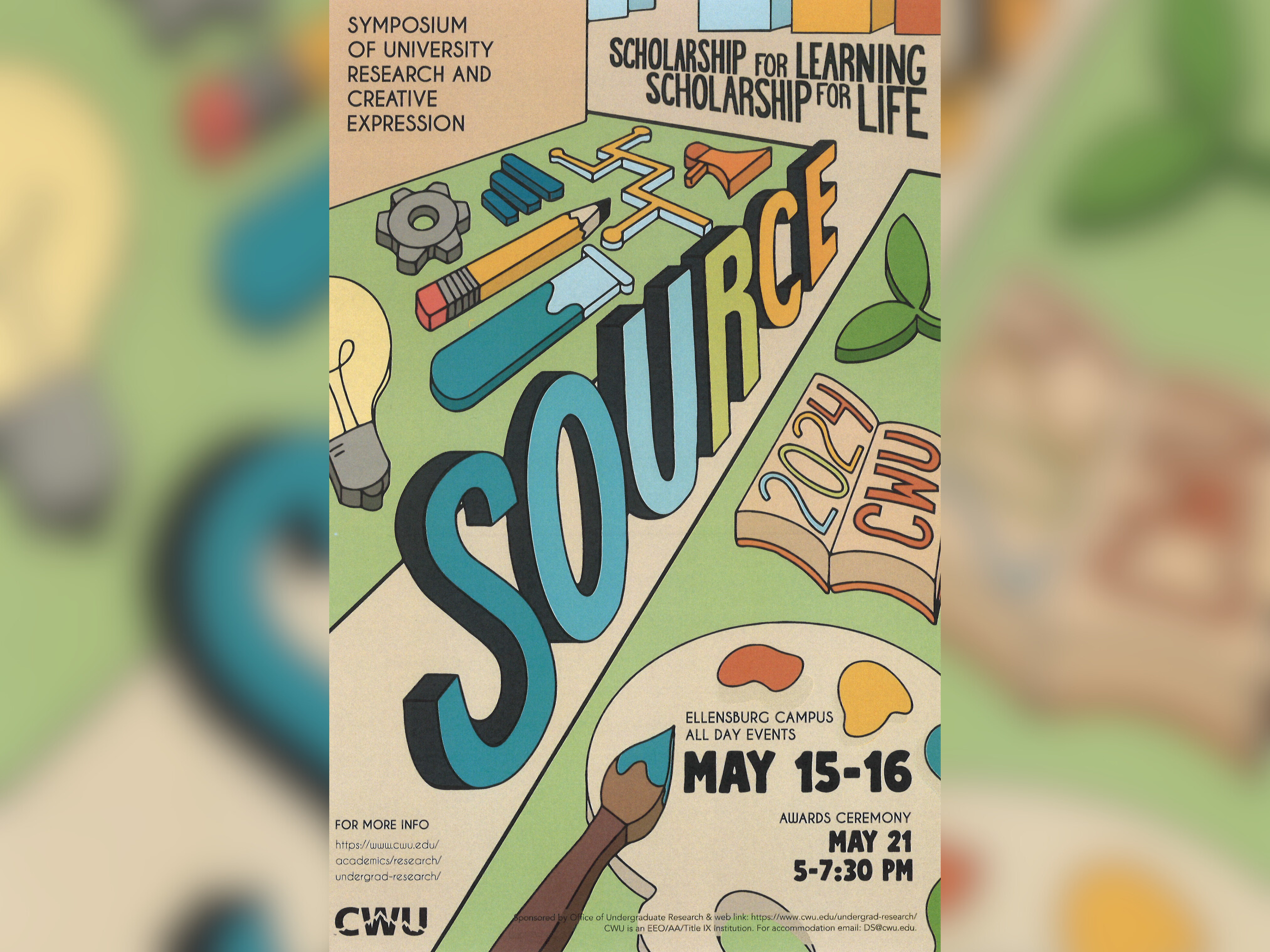

CWU News

CWU to highlight student research at next week’s SOURCE conference

May 8, 2024

by Rune Torgersen

CWU Theatre and Film to present ‘Footloose’ the next two weekends

May 8, 2024

by University Relations