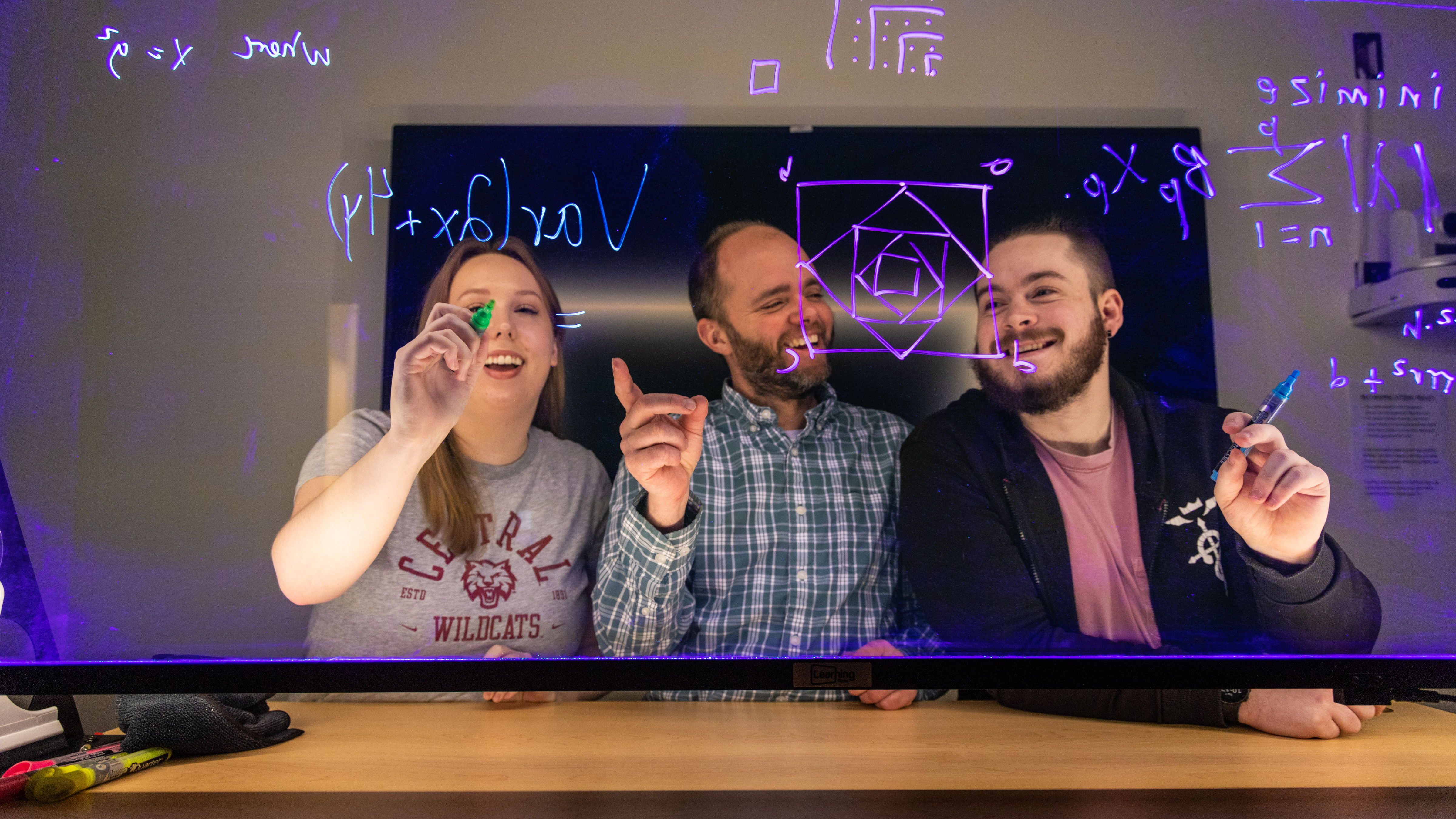

Mathematics

Actuarial Science FAQ

Q: How do I enter the Actuarial Science program at CWU?

Start by applying to Central through the Admissions Office! Their webpage has information that will answer most of your questions about admission to Central. If your questions are not answered there, feel free to contact one of their staff using the contact information on their webpage.

After you are accepted by Central, your next step is to talk with one of the actuarial science faculty advisors about a course of study. See below about requirements to formally declare the major – but do talk to an actuarial science faculty advisor as early as possible!

Q: Is the program competitive admission?

Not at present. The math department requires that you have completed Calculus I and II (CWU MATH 172 and 173) with grades of C (2.0) or better before declaring a major in the department. Once you’ve completed Calculus I and II, contact a faculty advisor about declaring the actuarial science major! If you haven’t yet completed MATH 172 and 173, contact a faculty member anyway – we can develop a plan of study with you that will help you reach your goals as efficiently as possible!

Q: I'm a transfer student from a two-year or community college. What courses should I take before transferring?

The math department has general information for transfer students.

In general, a well-prepared student with four quarters of calculus (CWU Math 172, 173, 272, and 273) can complete the program in two years, beginning in a fall quarter. Other courses which can be taken at a community college that apply to major requirements include introductory microeconomics and macroeconomics (CWU Econ 201 and 202), introductory accounting (CWU ACCT 251), and linear algebra (CWU Math 265). While it is not necessary to have taken all of these before transferring to CWU, taking at least a couple is helpful. A couple of more specific notes are below.

A note about accounting: Starting in the 2021-22 academic year, TWO quarters of accounting at most community colleges (ACCT& 201 and ACCT& 202) will be required to receive credit for CWU ACCT 251. Unless you have space in your community college schedule to take two quarters of accounting, you may want to wait and take accounting at CWU.

A note about calculus: Students who will be transferring with fewer than four quarters of calculus are strongly encouraged to talk to a faculty advisor about course planning and time to graduation. In particular, students who will have one of Calculus III/Multivariate Calculus I (CWU Math 272) or Calculus IV/Multivariate Calculus II (CWU Math 273) but not both need to speak to a faculty member about placement. The division of material between Calculus III and Calculus IV varies substantially between schools, and correct placement is important in order to be successful in later coursework.

Q: What percentage of students that graduate from Central Washington University with a B.S. Actuarial Science degree end up working as an actuary? Where are these graduates employed?

We don’t have exact statistics on the percentage of graduates who are working as an actuary; this is partly because “actuary” is a rather fluid term, with a growing number of people who would call themselves actuaries working in non-traditional areas. Not everyone who graduates from the program intends to be an exam-track actuary. As a rough figure, of those who are planning to be exam-track actuaries and have passed at least 2 actuarial exams by graduation, approximately 75-80% are employed in an exam-track position within 6 months of graduation. The percentages go down somewhat for those who have passed one exam. Besides success on exams, employers are especially interested in “soft skills” – writing and communication skills in particular. The major builds these skills into our coursework, including a major statistical project and presentation in the senior-level applied statistics course and a capstone senior project where students apply the skills and knowledge learned over the entire major to a project they design.

Recent graduates are employed at Premera Insurance, Cambia Health Solutions (parent company to Regence Insurance), Milliman Consulting, Symetra, Pemco, and others. We also have graduates working in the office of the State Insurance Commissioner, the State Actuary, and had someone for a time working at the state Health Care Authority.

Q: What else can I do with an actuarial science degree?

Many different things! We have had students use the degree as preparation for graduate work in a variety of disciplines (usually with a minor or second major in another area). Our graduates are also well-prepared for any position that requires critical thinking and data analysis. Recent graduates have worked at Boeing and the state Department of Social and Health Services. A growing number of actuaries are working in risk management positions, both for actuarial and non-actuarial employers.

Q: What kind of job placement programs does Central offer?

Central’s Career Services office offers general support for Central students, including advice on crafting a resume and mock interviews that students describe as extremely helpful. In conjunction with the actuarial student club, we also host visits each year from several companies who are recruiting for internships and entry-level positions. Some companies who visit regularly include Mercer Consulting, Symetra, Cambia/Regence, and Premera. Some companies do informational interviews with our students, which is a great way for students to get some practice interviewing and to impress someone who may be looking at their application down the road.

Q: What are the benefits of majoring in this specialized degree rather than just the general Mathematics, BS?

If you want to be an actuary, then the actuarial science degree is the degree for you! The degree includes not only the mathematical knowledge needed to be an actuary, but also the actuarial and communication skills that are required. The actuarial science degree will give you the strongest possible preparation for both the credentialing exams and for your future career. It’s much more focused than a general mathematics degree, and includes specialized coursework that covers many of the preliminary exams, as well as a strong background in probability and statistics. In addition, you’ll meet other future actuaries and be able to make connections with our network of alumni.

Q: Is the actuarial science program offered online or on any other CWU campuses?

No, as of 2023 we currently only offer traditional classes on the main campus in Ellensburg, where we feel that we can offer an ideal amount of interaction with faculty and other students. If future demand and staffing permit, we may consider expanding to a hybrid online/in-person program, but we have no immediate plans in that direction. We do have current students who commute daily or weekly from Yakima or Seattle. For well-prepared students with four quarters of calculus, the program can be completed in two years in residence at CWU.

Q: What courses are required for the Actuarial Science major?

Please see the list of courses on the program homepage or consult the current CWU catalog.

Q: What does a possible course plan look like?

Please see this sheet for one version of a suggested course of study. However, it is important to talk to a faculty advisor, because your advisor can help you plan your courses in a way that makes the most sense for you! In particular, students entering CWU as first-year students may choose to take some of the courses that correspond to actuarial exam material earlier than shown here, and the course plan for transfer students will depend on the exact courses being transferred.

Please note that a grade of C/2.0 or better is required for all courses in the actuarial science major, and that the mathematics department requires a grade of C/2.0 in all courses used as pre-requisites for math courses.

Q: Besides major courses, are there other courses I should take? Are there suggested minors or second majors?

Although a minor or second major is not required with the actuarial science major, many of our students choose to complement their actuarial science degree with minors or a second major. Common minor choices include:

- Economics (currently 10 credits beyond the economics courses required for the actuarial science major)

- Finance (also 10 credits beyond the courses required for the major)

- Computer Science (the applied computer science option is the most common of the two options)

- Modern Computer Applications from the ITAM department

Other options include a minor in general business or in supply chain management. Really, though, there are no bad minors! Any academic discipline will give you skills and a new way of thinking about the world that will be useful in actuarial work.

The most common double-majors are mathematics, economics, and finance. If you are thinking about double-majoring, it is crucial to talk to both advisors early, to put together a course plan that will work for both programs!

If you are just looking for some extra courses, good options include additional coursework in economics (intermediate macro- and micro-economics, econometrics, or forecasting are good choices), computer science, or computer applications. In particular, many actuaries make heavy use of Excel and Access. IT 260, IT 359, and IT 469 are all good options for building skills with spreadsheets and databases (note that some of these courses have pre-requisites).

Q: Who are potential actuarial employers in your region?

A partial list of employers includes Symetra, SAFECO, American Pet Insurance, Guy Carpenter, Liberty Mutual, Milliman, Mercer Consulting, PEMCO, Regence, Premera, Boeing, Starbucks, Towers Watson, the Washington State Insurance Commissioner’s Office, the Office of the State Actuary, and many others! For more potential actuarial employers, see the Society of Actuaries website; there are over 90 employers in Washington and Oregon employing over 400 credentialed actuaries!

Q: I have a bachelor’s degree in another field but would like to become an actuary. What are my options? Are there advantages or disadvantages to attending CWU’s program as a post-baccalaureate student vs. looking at masters’ programs?

We typically have two to three students/year who are doing actuarial science as post-bacs/second degrees. This may be bit more common in actuarial science than it is in other fields, because actuarial science/risk management master’s programs are not as common.

If you already have a bachelor’s degree, you have a couple of options at CWU. One option is to do the full program and earn a second bachelor’s degree, this one in actuarial science. This option usually takes two academic years, beginning in fall quarter, assuming a student starts with 3 or 4 quarters of calculus.

Another option (that doesn’t lead to a second degree) is to take enough calculus at a community college near you that you can start at CWU in the junior-level actuarial sequences (this is three to four quarters of calculus). Then plan on a year at Central, taking our junior-level sequences (which cover the material for Exams P and FM) and as many of the VEE courses as will fit. You could then take an exam or two in the spring, and, assuming those go well, look for actuarial positions. This plan would mean you’re only in residence at Central for an academic year. Please talk to a faculty advisor about how to plan your time at CWU!

For information about financial aid available to post-baccalaureate students, contact the financial aid office. We have a small amount of scholarship funds in the program that are open to everyone; a typical award amount is $500-1200 for an academic year, and they are competitive.

If you’re considering master’s programs, you’ll want to look carefully at what background they assume their incoming students have. Financially, you also want to look at whether their students receive funding – and if so, how many students get funding? Is the amount adequate to live on? If a program doesn’t fund students and it’s an out-of-state program, it may be more expensive than a year or two at CWU, particularly at in-state tuition rates.

Q: Is there an actuarial science club?

Yes! The actuarial science club is a student-led club that sponsors social events, study groups, career development workshops, visits by alumni and recruiters, field trips, and more! If you are a current students who would like to join the actuarial science club, please contact one of the faculty advisors, who can contact one of the club officers and have you added to the club e-mail list. If you’re in actuarial courses, you can also just watch for announcements!

For further information about Central Actuarial, or if you have other questions that are not answered here, please contact:

Dr. Sooie Hoe Loke E-mail: SooieHoe.Loke@cwu.edu Phone: 509-963-1389

Dr. Yvonne Chueh, ASA E-mail: Chueh@cwu.edu Phone: 509-963-2124

Dr. Sahadeb Upretee E-mail: Sahadeb.Upretee@cwu.edu Phone: 509-963-2104

CWU News

$4 million federal grant aimed at helping with school psychologist shortage

February 25, 2026 by Marketing and Communications

CWU Disability Services aims to provide equitable access to education

February 23, 2026 by Rune Torgersen